- How Does an Auto Loan Work?

- Common Types of Auto Loans

- The Basics of Auto Loan Rates

- Interest Rates vs. APRs

- Factors That Affect Auto Loan Rates

- How Does Credit Score Affect Auto Loan Interest Rates?

- Common Auto Loan Fees

- How To Apply for an Auto Loan

- How Much Can I Spend on My Auto Loan?

- Where To Get an Auto Loan

- Preapproval vs. Prequalification

- How To Get the Best Auto Loan Rate

- How To Apply for an Auto Loan

- How Much Can I Spend on My Auto Loan?

- Where To Get an Auto Loan

- Preapproval vs. Prequalification

- How To Get the Best Auto Loan Rate

- Guide to Auto Loans: FAQ

- What should you consider when getting an auto loan?

- What bank is best for auto loans?

- What’s a good APR for a car loan?

- Is 72 months good for a car loan?

- Auto loans are available from banks, dealerships, and online lenders.

- Comparing rates from multiple lenders is the easiest way to get a good deal.

- Interest rates depend on your credit score, the vehicle you’re financing, and other factors.

There’s a lot to consider when taking out a loan to purchase or refinance a car. Even if it seems like a good time to buy a vehicle, it’s easy to forget some steps when moving through the loan application process. Our team has assembled this guide to auto loans to help you better understand the car financing world so that you can secure the best auto loan rates.

How Does an Auto Loan Work?

Most auto loans are secured loans, meaning they’re backed by real property, known as collateral. Car loans, whether they’re used to purchase or refinance new or used vehicles, are some of the most common loans taken out from financial institutions. Note that auto loans typically have far lower interest rates than credit cards or personal loans.

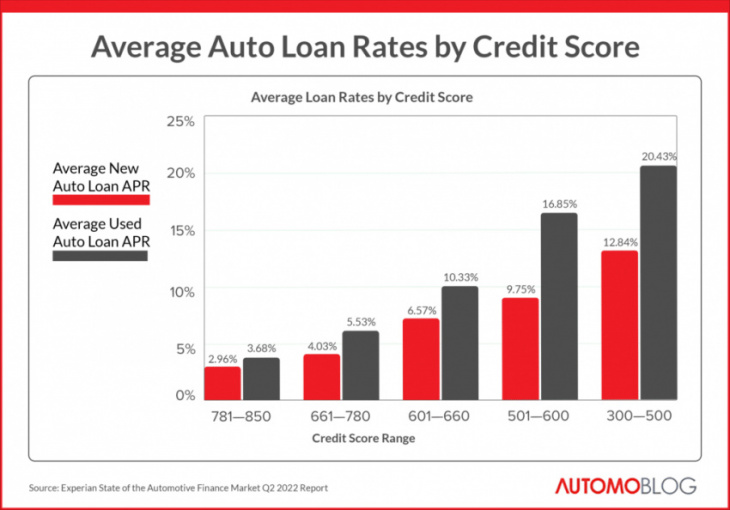

Annual percentage rates (APRs), which include the loan interest rate plus any added fees, can sometimes be as low as 3%. These rock-bottom rates are only available to those with excellent credit, so most drivers will receive higher APRs. The average auto loan rate is currently 4.33% for new cars and 8.62% for used cars, according to Experian’s State of the Automotive Finance Market Q2 2022 report.

Auto loan terms can range anywhere from 12 to 84 months. Buyers should approach 84-month loans with extreme caution, as they often come with low monthly auto loan payments but high interest rates. You’ll likely be paying for your vehicle beyond its best years and could easily end up underwater on your new car.

Common Types of Auto Loans

Lenders offer a variety of financing options to help borrowers purchase or refinance cars. Here’s a quick breakdown of the different types of auto loans:

- Purchase loans: These are loans used to buy a new or used car from a licensed dealer. You’ll typically find lower interest rates on new car loans than on used car loans.

- Private-party loans: When buying a vehicle from a private seller, this is the type of loan that you’ll need. Many lenders don’t offer private-party financing because it’s seen as riskier than purchase loans.

- Lease buyout loans: Lease agreements come with set monthly payments and often last for 12 to 36 months. Drivers return leased vehicles at the end of the lease term unless they decide to purchase with a lease buyout loan.

- Refinancing loans: A standard auto refinance loan alters your current loan by offering a different loan term or interest rate. There are also cash-out refinance loans, which allow you to borrow more money by accessing the equity in your vehicle.

The Basics of Auto Loan Rates

Understanding the terms used by auto lenders can help you navigate the process of applying for and securing an auto loan. People often use interest rates and APRs interchangeably, but there are subtle differences between the two.

Interest Rates vs. APRs

Interest rates refer to the actual percentage of interest a lender charges you to borrow money. APRs include the base interest rate, but also factor in any added fees. Due to this distinction, you’ll get a more accurate measure of how much you’ll actually pay by looking at the APR.

Factors That Affect Auto Loan Rates

Auto loans carry different interest rates depending on the borrower and the lender. When you apply for a car loan, lenders look at the following metrics to determine the APR you’ll pay:

- Market conditions: There’s plenty of competition in the auto lending industry. Lenders take their competitors’ rates into account when setting their own numbers.

- Federal interest rate: This plays an important role in determining auto loan interest rates. The federal interest rate sets the rate at which financial institutions borrow money, so APRs for loans generally change after a federal rate increase.

- Length of loan: Longer-term loans bring lower monthly payments but typically come with higher interest rates, meaning that they could cost more in the end.

- Vehicle details: The make and model year of the vehicle you’re financing factors into the interest rate of a car loan. Lenders tend to charge higher interest rates for higher-mileage and older used vehicles.

- Debt-to-income (DTI) ratio: Your DTI ratio is your percentage of monthly debt payments compared to your monthly gross income. A DTI ratio of 43% or higher is considered risky by just about any lender.

Any guide to auto loans should mention that those with a high DTI ratio should consider working to lower their debts before purchasing a new vehicle. Similarly, those who’d need a 72- or 84-month car loan may be better off remaining out of the market if possible.

How Does Credit Score Affect Auto Loan Interest Rates?

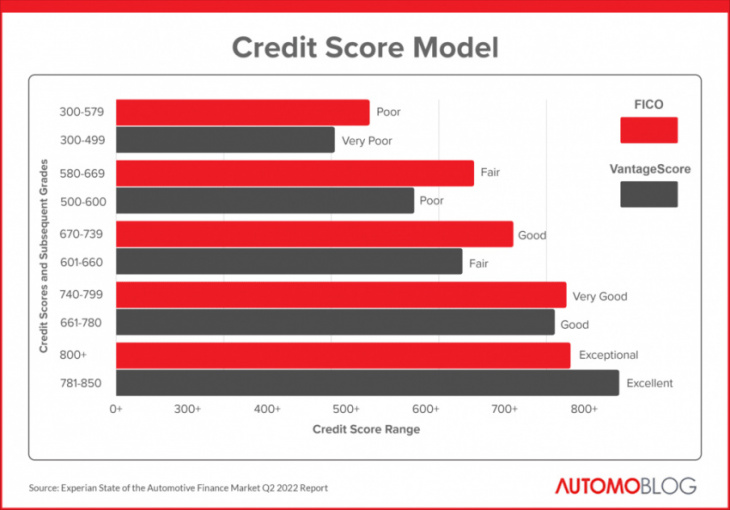

Credit scores also factor heavily into the calculation of auto loan interest rates. Borrowers with excellent credit usually have an easier time securing loans with competitive APRs, while those searching for bad credit car loans pay significantly more in interest.

Credit Scoring Models

Most lenders use FICO credit scores as they evaluate potential borrowers, though some prefer to use scores from Vantage. Each standard gives scores between 300 and 850, with borrowers fitting into one of the credit bands listed below.

Common Auto Loan Fees

You’ll find a variety of costs and fees associated with almost any auto loan. Although not all car lenders charge the same fees, the ones outlined below are extremely common:

- Application fee: Many lenders charge a flat fee for submitting a loan application during the car buying process.

- Origination fee: Lenders charge this fee to process new car loans. This fee can either be a percentage of the loan amount or a set amount.

- Prepayment fee: Lenders sometimes charge a fee if you pay off an auto loan early. This helps to reimburse lenders for any interest payments that they miss out on.

It’s also a regular occurrence for lenders to charge fees for late or returned car payments. In rare cases, lenders could charge fees for paying online or with a credit card.

How To Apply for an Auto Loan

It’s relatively easy to apply for a car loan, especially when you follow this guide. Rather than having to go to a dealership or a bank, you can now fill out a car loan application on your computer or smartphone.

How Much Can I Spend on My Auto Loan?

Before beginning the loan application process, you need to know exactly what your budget is. Allotting 10% or less of your take-home pay to your combined car expenses is a good idea. This number should include your auto loan, car insurance, gas expenses, and repair costs. Many car lenders offer auto loan calculators to help you learn how much you can afford.

Where To Get an Auto Loan

You can secure an auto loan from a variety of places depending on minimum loan amounts. Different lending options bring distinct advantages and downsides, so it’s best to fully explore your options. Here are a few common types of auto lending institutions:

- Banks: Traditional banks are popular choices due to their competitive rates and the discounts given to customers who already have checking accounts or lines of credit with the institutions. Online banking options can also benefit some potential car and motorcycle buyers.

- Credit unions: These member-owned organizations are similar to banks in many ways but often have less strict lending requirements and lower interest rates. It’s usually easy to join a credit union with either a nominal fee or a charity donation.

- Car dealerships: In-house financing options are prevalent at car dealerships, and you might find lower interest rates from dealers than from banks. Larger dealerships sometimes extend extremely low APR offers to those with excellent credit. Note that auto dealers often try to tack on extras such as warranties and gap insurance, which aren’t necessary for all drivers.

- Online lenders: You’ll find a variety of online options for auto loans, some of which are from direct lenders with the backing of large financial institutions. There are also many lending brokers on the internet that can help you find the best loan rates.

Make sure to only reach out to reputable lenders when you’re looking to finance or refinance a vehicle. While our guide to auto loans can walk you through the standard process, it’s important that you find a legitimate lender or your information could fall into the wrong hands.

Preapproval vs. Prequalification

You’re likely to encounter the terms “preapproved” and “prequalified” as you navigate the world of auto loans. There are similarities between these terms, but plenty of differences as well.

Being prequalified means you’ve received an estimate for how much you can borrow from a financial institution. There’s no firm loan offer attached here; it’s a quote rather than a commitment from a lender. Financial institutions use soft credit checks for prequalification, so your credit score won’t be affected.

To get preapproved for an auto loan means that a lender has done a hard credit pull and made a firm loan offer to you. Your credit score could temporarily dip if you apply for preapproval from multiple lenders over a few weeks. However, securing preapproval gives you leverage when negotiating with a dealer by making you similar to a cash buyer.

How To Get the Best Auto Loan Rate

Along with comparing rates from multiple lenders and doing whatever you can to raise your credit score, here are some strategies you can use to get the best deal on an auto loan:

- Shorten your loan term: Shorter-term vehicle loans place less risk on auto lenders, so they typically have lower APRs than long-term options. Although monthly payments will often be higher, drivers will save considerable money due to the shorter loan term.

- Use autopay: Many lenders offer rate discounts for using automatic payment systems.

- Bump up your down payment: This may not be possible for all drivers, but making a higher down payment by using the value of your trade-in often leads to lower APRs.

- Find a co-signer: If you don’t have a strong credit score, try to find a family member or friend with excellent credit who will co-sign on your loan. Just make sure you can make your monthly loan payments, or both your and your co-signer’s credit ratings will suffer.

- Get preapproved: Serious car buyers should consider applying for preapproval rather than prequalification to receive firm offers from lenders. This can help you to find more competitive APRs, which could outweigh the temporary hit to your credit score.

When you’re looking for the best reasonable auto loan rates, always do your research and consider offers from multiple lenders.

How To Apply for an Auto Loan

It’s relatively easy to apply for a car loan, especially when you follow this guide. Rather than having to go to a dealership or a bank, you can now fill out a car loan application on your computer or smartphone.

How Much Can I Spend on My Auto Loan?

Before beginning the loan application process, you need to know exactly what your budget is. Allotting 10% or less of your take-home pay to your combined car expenses is a good idea. This number should include your auto loan, car insurance, gas expenses, and repair costs. Many car lenders offer auto loan calculators to help you learn how much you can afford.

Where To Get an Auto Loan

You can secure an auto loan from a variety of places depending on minimum loan amounts. Different lending options bring distinct advantages and downsides, so it’s best to fully explore your options. Here are a few common types of auto lending institutions:

- Banks: Traditional banks are popular choices due to their competitive rates and the discounts given to customers who already have checking accounts or lines of credit with the institutions. Online banking options can also benefit some potential car and motorcycle buyers.

- Credit unions: These member-owned organizations are similar to banks in many ways but often have less strict lending requirements and lower interest rates. It’s usually easy to join a credit union with either a nominal fee or a charity donation.

- Car dealerships: In-house financing options are prevalent at car dealerships, and you might find lower interest rates from dealers than from banks. Larger dealerships sometimes extend extremely low APR offers to those with excellent credit. Note that auto dealers often try to tack on extras such as warranties and gap insurance, which aren’t necessary for all drivers.

- Online lenders: You’ll find a variety of online options for auto loans, some of which are from direct lenders with the backing of large financial institutions. There are also many lending brokers on the internet that can help you find the best loan rates.

Make sure to only reach out to reputable lenders when you’re looking to finance or refinance a vehicle. While our guide to auto loans can walk you through the standard process, it’s important that you find a legitimate lender or your information could fall into the wrong hands.

Preapproval vs. Prequalification

You’re likely to encounter the terms “preapproved” and “prequalified” as you navigate the world of auto loans. There are similarities between these terms, but plenty of differences as well.

Being prequalified means you’ve received an estimate for how much you can borrow from a financial institution. There’s no firm loan offer attached here; it’s a quote rather than a commitment from a lender. Financial institutions use soft credit checks for prequalification, so your credit score won’t be affected.

To get preapproved for an auto loan means that a lender has done a hard credit pull and made a firm loan offer to you. Your credit score could temporarily dip if you apply for preapproval from multiple lenders over a few weeks. However, securing preapproval gives you leverage when negotiating with a dealer by making you similar to a cash buyer.

How To Get the Best Auto Loan Rate

Along with comparing rates from multiple lenders and doing whatever you can to raise your credit score, here are some strategies you can use to get the best deal on an auto loan:

- Shorten your loan term: Shorter-term vehicle loans place less risk on auto lenders, so they typically have lower APRs than long-term options. Although monthly payments will often be higher, drivers will save considerable money due to the shorter loan term.

- Use autopay: Many lenders offer rate discounts for using automatic payment systems.

- Bump up your down payment: This may not be possible for all drivers, but making a higher down payment by using the value of your trade-in often leads to lower APRs.

- Find a co-signer: If you don’t have a strong credit score, try to find a family member or friend with excellent credit who will co-sign on your loan. Just make sure you can make your monthly loan payments, or both your and your co-signer’s credit ratings will suffer.

- Get preapproved: Serious car buyers should consider applying for preapproval rather than prequalification to receive firm offers from lenders. This can help you to find more competitive APRs, which could outweigh the temporary hit to your credit score.

When you’re looking for the best reasonable auto loan rates, always do your research and consider offers from multiple lenders.

Guide to Auto Loans: FAQ

What should you consider when getting an auto loan?

When getting an auto loan, consider whether you can afford a new vehicle, if now is the right time to get a car loan, whether you’re likely to qualify for a competitive APR, and whether you have the required documents on hand. This guide to auto loans explains other important details to think about before you apply for a car loan.

What bank is best for auto loans?

Our team ranks Bank of America as the top bank for auto loans. Consumers Credit Union is our top pick for credit unions, while myAutoloan is our highest-rated online lender for auto financing.

What’s a good APR for a car loan?

According to Experian, the average auto loan rates in 2022 are 4.33% for new vehicles and 8.62% for used cars. To get the market’s lowest rates, it’s best to shop around and compare quotes from multiple lenders.

Is 72 months good for a car loan?

No, 72 months is generally on the long side for an auto loan. It’s recommended to get a shorter car loan if possible, as drivers who take out 72-month terms often end up underwater, or paying more overall than their vehicle is worth.

Keyword: Guide to Auto Loans