- How Do I Use a Car Loan Calculator?

- Breakdown of Auto Loans

- Types of Car Loan Calculators

- How Do I Use a Car Loan Calculator?

- Prepare Your Information

- Determine Your Budget

- Find Your Estimated Monthly Payment

- Get Preapproved or Prequalified

- Start Applying for Loans

- Car Loan Calculator: Conclusion

- Recommended Auto Loan Providers

- Car Loan Calculator: FAQ

- Is it smart to do a 72-month car loan?

- How much are payments on a $30,000 car?

- How do you calculate an auto loan payment?

- Is it worth paying off your car loan early?

- Is 2.9% APR good for a car?

- Our Methodology

Compare Auto Loan Rates

Compare which options fit your budget, credit score, and term length below.

Loan Term All

- All

- 24 to 84 months

- 36 to 84 months

- 36 to 72 months

- 12 to 72 months

Min. Credit Score All

- All

- 300

- 500

- 560

- 575

- 580

Brand

Min Cred Score

Min Rate Term

Min APR*

Features

Links

Used Car Loan

MinRate Term 24 to 84 months

Min

APR* 2.49%

- Below-average credit scores accepted

- Great interest rates

- Smooth and easy online experience

Get Quote

Refinance Loan

MinRate Term 36 to 84 months

Min

APR* 1.99%

- Average monthly savings of $145

- Online Application

- Browse loan options found specifically for you

Get Quote

Used Car Loan

MinRate Term 36 to 72 months

Min

APR* 3.99%

- Great for customers with limited/no credit

- Offers special military rates

- A+ BBB rating

Get Quote

Refinance Loan

MinRate Term 36 to 72 months

Min

APR* 3.99%

- Great for customers with limited/no credit

- Offers special military rates

- A+ BBB rating

Get Quote

Refinance Loan

MinRate Term 24 to 84 months

Min

APR* 1.99%

- Below-average credit scores accepted

- Great interest rates

- Smooth and easy online experience

Get Quote

Refinance Loan

MinRate Term 12 to 72 months

Min

APR* 1.99%

- Specializes in auto refinancing

- A+ BBB Rating

- No application fee

Get Quote

New Car Loan

MinRate Term 24 to 84 months

Min

APR* 2.24%

- Below-average credit scores

- Great interest rates

- Smooth and easy online experience

Get Quote

Refinance Loan

MinRate Term 36 to 72 months

Min

APR* 2.32%

- Average savings of $111/month

- Secure, fully online platform

- Refinancing available for cars, trucks, or SUVs

Get Quote

*All APR figures last updated on 5/25/2022 – please check partner sites for latest details. Your rate may vary based on credit score, credit history, and loan term.

- Car loan calculators help potential buyers figure out how much they can spend on a new vehicle.

- It’s smart to get preapproved for an auto loan if you’re serious about purchasing a car in the short term.

- Those with good credit, large down payments, and shorter term lengths are likely to pay less on an auto loan.

A car loan calculator is one of the most valuable tools available when it comes to auto financing. You’ll gain plenty of insight, whether you’re looking to purchase a new or used car, searching for a refinance auto loan, or just considering your budget. You can use the information provided by the car loan calculator to help you find the market’s best auto loan rates.

How Do I Use a Car Loan Calculator?

Many people will use an auto loan calculator to determine how much their monthly car payment will be. Others want to establish a budget for purchasing a new car. People considering an auto refinance may seek to find out how much they can save.

Breakdown of Auto Loans

The type of automotive finance tool you need depends on the type of loan you’re looking for. Here are the most common types of auto loans:

- Purchase loan: Finances the purchase of a new or used vehicle

- Refinance loan: Replaces your current auto loan with a new one

- Lease buyout: Finances the purchase of a leased vehicle, sometimes before the end of your lease term

Types of Car Loan Calculators

Many online tools combine multiple types of auto loan calculators, but how to use each type and what you can learn varies.

Affordability Calculator

An affordability calculator helps you to estimate your purchase budget. After putting in some financial information such as your income and monthly obligations, you’ll get an estimated budget. An affordability calculator shows you what types of cars you can reasonably afford.

Car Payment Calculator

A car loan payment calculator lets you calculate the estimated monthly payment for your new vehicle. You can see how adjusting things like your down payment amount, trade-in value, or loan term can change your car payments.

Refinance Loan Calculator

If you’re looking for auto refinancing, a refinance calculator can show you the amount that you could save. Adjust variables like your down payment and loan term to see how different loan structures would change what you pay in interest.

How Do I Use a Car Loan Calculator?

Most car financing calculators and auto loan amortization schedules are fairly intuitive. However, the kinds of information you put into the tool as well as the information you get out may be less obvious. Taking an organized approach to using an auto loan calculator can put you in position to make the best financial decision.

Prepare Your Information

You can use an auto financing calculator with some general information about your income and credit score. The more details you supply, though, the more accurate the picture will be of what you can afford.

Before using a car loan calculator, it’s wise to have the following information on hand:

- Income: A major piece of the affordability equation

- Housing costs: Your monthly rent or home mortgage

- Debt obligations: How much you spend each month to keep up with credit cards, personal loans, and other debts

- Credit score: Your current credit score will help give you an idea of what you’ll pay each month on a car loan

How To Find Your Credit Score for Free

You may not know your credit score offhand, but there are a few ways to check without having to pay. Below are a few of the simplest strategies:

- Check with your credit card company: Many credit card providers now include free credit score access with their accounts. If you have a credit card, check to see if your provider offers this feature.

- Request a free credit report: You are entitled to one free credit report each year from each of the major credit reporting services. Equifax, TransUnion, and Experian each have tools to obtain your free report.

- Sign up for a free credit monitoring service: Several reputable companies offer credit monitoring for free through limited versions of their services. While you may need to pay to access detailed information, you may get free access to your current score.

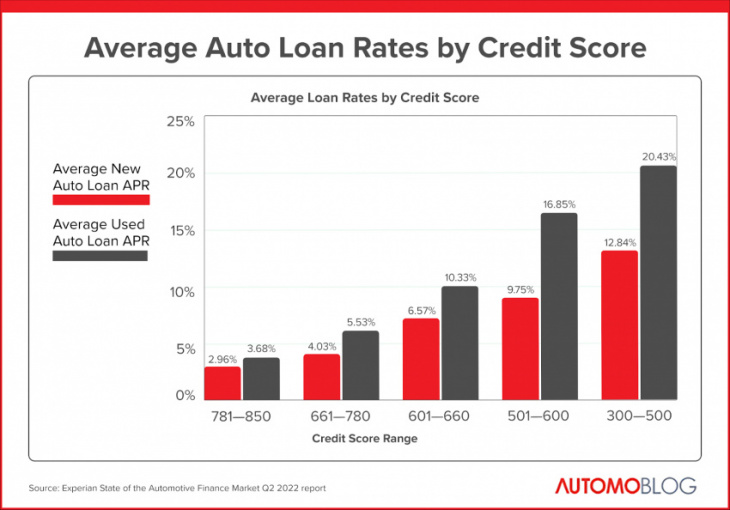

Average Car Loan Interest Rates by Credit Score

The following chart shows the average interest rates for new and used cars by FICO credit score. This data is based on the Experian State of Automotive Finance Market Q2 2022 report.

Determine Your Budget

Unless you already know what you can afford and want to spend, figuring out your budget will be the next step in the process. For this, you’ll want to use a car affordability calculator.

After you enter your income, expenses, and credit score in some instances, you’ll get an estimated purchase budget. Note that this is typically the maximum car price you can afford. You can always choose to spend less, and that’s usually the more responsible move.

Find Your Estimated Monthly Payment

Once you’ve determined your budget, use a car payment calculator to see how different factors could affect your monthly payments and total interest costs. Below are the variables that contribute to the total cost of your auto loan:

Car Purchase Price

When inputting the price of the car into an auto loan calculator, be sure to consider all the additional factors in the purchase price such as dealer fees, sales tax, and any discounts or cash rebates.

Term Length

Auto loan terms usually range from 24 to 84 months, but sometimes extend beyond that. Longer terms often come with lower monthly car loan payments, but expect to pay more over time due to greater interest.

Down Payment

Whether you’ll be using cash or a trade-in vehicle, a larger down payment will decrease the amount you need to borrow. This lowers your loan-to-value (LTV) ratio, which is the value of your auto loan compared to the value of the vehicle you’re hoping to buy. Lowering your LTV ratio by setting a large down payment will often give you a more affordable rate.

Interest Rate

The interest rate you receive is largely dependent on your credit score, but adjusting your down payment and loan term can also affect it. A car loan calculator may automatically set your interest rate based on other variables, or you may need to enter it manually.

It’s important to note that while “interest rate” and “annual percentage rate” (APR) are often used interchangeably, they have somewhat different meanings. An interest rate is the actual amount of interest the lender charges to loan you money while an APR also includes taxes, fees, and discounts that get rolled into your auto loan.

Sales Taxes

You’ll likely pay sales tax in the state where you register your new vehicle. Each state sets its own sales tax rate so you don’t have control over this amount. However, you’ll still need to include this information in the car loan calculator to get an accurate estimate.

Common Fees

Buying or refinancing a vehicle comes with several fees that can be rolled into your auto loan. Even if you don’t combine them, you’ll still need to consider the fees as part of your budget.

Here are some of the most common fees you could face:

- Registration: Depends on the state where you live

- Car title: You’ll need to pay the title fee your state charges even if the car title belongs to your lender

- Dealer fees: Point-of-sale fees from your car dealer that may be negotiable

- Loan origination: Lenders charge varying origination fees to open and service your auto loan

Get Preapproved or Prequalified

Many lenders offer car loan prequalification. This is an estimate from an auto lender of how much you could be able to afford based on the details supplied. You can use the information you learned from the car loan calculator to set your total loan amount.

Prequalification requires a soft credit inquiry at most, meaning it won’t impact your credit score. As a result, prequalification doesn’t actually guarantee financing. It’s more of a guide to help you shop before actually applying for a loan.

Preapproval, on the other hand, requires a hard credit check. While this could negatively affect your credit score over the short term, it also guarantees auto financing. Many auto lenders offer a preapproval check that you can use while shopping for a new vehicle. As long as the car you choose meets your lender’s requirements, this check is as good as cash to a car dealer.

Start Applying for Loans

It’s now time to start applying for car loans. While you’ll go through a hard credit check, applying for multiple auto loans in under two weeks counts as a single hard credit inquiry. Below are a few places you can head to for your auto financing or refinancing needs.

Banks

Traditional banks are still the preferred source of financing for many people. Most banks have physical branches for in-person help, and they also tend to have robust online loan services, which sometimes include car loan calculators.

Credit Unions

Credit unions are member-based, not-for-profit alternatives to commercial banks. They offer a similar range of auto loan products as banks and often have competitive interest rates. While credit unions have historically been localized or open to only specific members, many national options are now open to the public.

Car Dealerships

Most car dealers offer in-house financing options. While a financial institution is actually the one that issues and services your loan, car dealers may increase the rate they get from that institution and take the difference as profit.

Car dealerships are the only places where you can regularly find incentives like a 0% APR. Be careful before picking up add-ons such as warranty plans from dealerships, though, as you may not need these services.

Online Lending Providers

Online-only auto lenders are becoming increasingly common. Some are newer direct providers without a physical presence while others are related to banks, are brokers, or even offer auto loan marketplaces.

Car Loan Calculator: Conclusion

An auto loan calculator is an extremely useful tool to help out as you consider buying a car. Depending on where you are in the process, these finance calculators can help you to set your budget, see what your monthly payments would be, and compare different loan terms.

The information you get can help you to shop for auto financing and make informed decisions when purchasing a car.

Recommended Auto Loan Providers

The best way to get excellent rates on auto financing is to shop around. Applying for car loans with multiple lenders won’t impact on your credit if done within a brief period of time, so it’s a valuable strategy when performed well.

Compare Auto Loan Rates

Compare which options fit your budget, credit score, and term length below.

Loan Term All

- All

- 24 to 84 months

- 36 to 84 months

- 36 to 72 months

- 12 to 72 months

Min. Credit Score All

- All

- 300

- 500

- 560

- 575

- 580

Brand

Min Cred Score

Min Rate Term

Min APR*

Features

Links

Used Car Loan

MinRate Term 24 to 84 months

Min

APR* 2.49%

- Below-average credit scores accepted

- Great interest rates

- Smooth and easy online experience

Get Quote

Refinance Loan

MinRate Term 36 to 84 months

Min

APR* 1.99%

- Average monthly savings of $145

- Online Application

- Browse loan options found specifically for you

Get Quote

Used Car Loan

MinRate Term 36 to 72 months

Min

APR* 3.99%

- Great for customers with limited/no credit

- Offers special military rates

- A+ BBB rating

Get Quote

Refinance Loan

MinRate Term 36 to 72 months

Min

APR* 3.99%

- Great for customers with limited/no credit

- Offers special military rates

- A+ BBB rating

Get Quote

Refinance Loan

MinRate Term 24 to 84 months

Min

APR* 1.99%

- Below-average credit scores accepted

- Great interest rates

- Smooth and easy online experience

Get Quote

Refinance Loan

MinRate Term 12 to 72 months

Min

APR* 1.99%

- Specializes in auto refinancing

- A+ BBB Rating

- No application fee

Get Quote

New Car Loan

MinRate Term 24 to 84 months

Min

APR* 2.24%

- Below-average credit scores

- Great interest rates

- Smooth and easy online experience

Get Quote

Refinance Loan

MinRate Term 36 to 72 months

Min

APR* 2.32%

- Average savings of $111/month

- Secure, fully online platform

- Refinancing available for cars, trucks, or SUVs

Get Quote

*All APR figures last updated on 5/25/2022 – please check partner sites for latest details. Your rate may vary based on credit score, credit history, and loan term.

myAutoloan: Best Loan Marketplace

One of our top picks, myAutoloan, is a car loan marketplace. Lenders send you offers once you enter information into the site, allowing you to easily compare multiple financing options. You’ll also find a car loan calculator from myAutoloan that can give you an idea of what rates, terms, and purchase budget could be available to you.

Auto Approve: Best for Refinancing

Auto Approve specializes in auto refinancing and ranks as our top option for those in the market. While you can’t get a purchase loan for a used or new car with the company, Auto Approve is one of the best options for refinancing a vehicle. The rates from Auto Approve are usually competitive and the lender accepts credit scores as low as 580.

Car Loan Calculator: FAQ

Is it smart to do a 72-month car loan?

Many experts suggest that it isn’t smart to do a 72-month car loan or longer if you can avoid it. This is because longer loan terms tend to come with higher interest rates, and you could easily find yourself upside down on the loan, or owing more on the car than it’s worth.

How much are payments on a $30,000 car?

Monthly payments on a $30,000 car depend on several variables. These factors include how large your down payment is, the interest rate you get, and your loan term. You could be able to estimate your monthly payments by using a reputable car loan calculator.

How do you calculate an auto loan payment?

A car loan calculator is the easiest way to calculate an auto loan payment. But if you want to figure it out by hand, you can calculate a car payment by dividing the total loan plus the interest amount by the remaining loan term.

Is it worth paying off your car loan early?

Paying off your car loan early can be worth it in many cases. However, it won’t be worth it if your auto loan carries prepayment penalties that exceed what you’d save by paying your loan off early.

Is 2.9% APR good for a car?

If you’re buying a new car and have excellent credit, 2.9% APR is about average. For used cars, 2.9% APR is generally a deal even if you have a strong credit score.

Our Methodology

Our expert review team takes satisfaction in providing accurate and unbiased information. We identified the following rating categories based on consumer survey data and conducted extensive research to formulate rankings of the best auto loan providers.

- Industry Standing:Trust and reliability are two of the most important qualities in a lender. Our team considers current industry ratings from organizations such as the Better Business Bureau (BBB) along with factors such as a company’s age.

- Availability:We examine how easy it is for borrowers to get a loan from each provider. Lenders that offer loans to meet a variety of customer needs receive high ratings.

- Loan Details:Our researchers comb through the fine print to learn about the loan amounts, term lengths, and types of loans each provider offers.

- Rates and Discounts: We take an in-depth look at the range of rates each provider offers for borrowers of different credit scores. Our team also factors in the discounts available with each lender.

- Customer Service:Our team considers customer reviews and complaints when determining this score. We also consider the ease and availability of help online, over the phone, or in person.

Keyword: Car Loan Calculator