- The false premise of EV rebates

- What explains the difference across car types?

- Economic levers – mechanical advantage is your political friend

- Scenario spit-balling – let’s put EV rebates into mining and see what happens

Image: Riz Akhtar

There is no doubt rebates for electric vehicles are popular on the political left. But in a supply constrained market, are they sensible?

Perhaps the more interesting question: in a supply constrained market, is there a better way to bring EVs down the cost curve for Australian citizens? The answer, I believe, is yes. And here is why.

The false premise of EV rebates

Taken straight from the ALP’s mouth on its Electric Car Discount, we can see the (false) premise behind rebate thinking:

“There are no electric cars available in Australia for under $40,000, and just five for under $60,000. In comparison, there are more than two dozen electric cars available in the UK for under AU$60,000 – including eight that are cheaper than the cheapest electric car in Australia. This is because the UK Government, and governments around the world, have introduced incentives and policies to help electric cars compete with older technology with lower upfront costs.”

Did you spot the premise? We are told the reason behind Australia’s higher cost EVs and smaller range to buy from, is that we don’t have EV ‘incentives and policies’ (i.e. subsidies).

If this were both true, and had a powerful effect on car pricing, then we would expect the cost of any car in Australia without explicit subsidy/support, to be higher than its UK counterpart. Here is how a few ICE models compare.

What explains the difference across car types?

Ford Fiesta is the top seller in the UK with Ford Focus no.2, while the Camry and Hilux are top sellers in Australia in their class. In other words, when supply is prioritised to a market based on demand, we see costs come down.

It is also no surprise the UK has a greater range of lower cost EVs than Australia, because their small car segment is their most popular segment. It is unlikely Australia will see small, cheap EV’s like the Renault Zoe, Honda-e, or ID.3 in any volume soon simply because Australians aren’t really small car buyers.

Not being able to accept our place in the EV world order, we project blame to policy – it is nice to feel like you have control over these things, however using rebates and incentives to create demand pull in a global market as a minnow, is a bit like being Monty Burns on a see-saw… it doesn’t give you much leverage!

Economic levers – mechanical advantage is your political friend

Give me a place to stand, and I will move the earth, so the saying goes. When it comes to shifting big objects or economic trends, you have to know where the leverage comes from.

So if we want to see EV uptake in Australia, and we accept the premise that costs need to come down to help drive demand, what are the most powerful levers? This is where a bit of first principles thinking and common sense can be usefully applied.

What are the primary drivers of the EV premium?

1. The cost of the battery pack;

2. Scale of EV production (i.e. lack of scale)

Let’s start with the cost of the battery pack. What drives battery pack costs?

1. The cost of mining/supplying battery metals;

2. How those metals are configured to store energy (“the technology”);

3. Scale of production.

Which of those variables can Australia influence most effectively?

1. Mining: We are recognised as a top tier, if not the world’s best mining jurisdiction and have become globally dominant in lithium mining over a short timeframe, so battery metals mining costs are a lever we can pull;

2. Technology: Australia has a history of science excellence, generally speaking, but no obvious competitive advantage in battery cell or pack design, let alone manufacturing. This is dominated by leading OEMs – Tesla and BYD, in collaboration with their suppliers (China, Japan, South Korea). Could we catch up? perhaps… ;

3. Production scale: We have no established EV production capability of global significance, albeit have developed strong competence in commercial niches (e.g. SEA-electric).

So battery metal mining looks promising – let’s play out battery metals as a lever, and see what happens.

1. Growing Australia’s share of battery metal mining improves our terms of trade – $AUD goes up? Cost of imports goes down. Ergo, grow our share of the forecast $400b/pa battery metal mining market, and simply by enhancing the value of $AUD, EV costs come down.

2. Accelerating battery metal supply addresses arguably the primary bottleneck on growing battery cell production – see “greenflation” paper by Goldman Sachs – and so is a powerful lever on EV costs that we have direct and immediate control over.

3. With geopolitical pressure creating demand for supply chain diversity, and W.A the only jurisdiction globally with all key battery metals, Australia has unique competitive advantage not only in mining, but attracting investment in value adding via chemical processing.

Driving down the cost of mining battery metals as a lever starts to look pretty good, with 2nd and 3rd order effects that benefit the nation as well as EV buyers.

Scenario spit-balling – let’s put EV rebates into mining and see what happens

For simplicity, let’s say Australian governments at all levels are putting up about $3,000 per EV, that this is maintained over a three-year period, and that over the three years, we average 50,000 EVs/pa. Forgive me the artistic license – EV demand is growing quickly, and political certainty over the timing and quantum of rebate is hard to unpack.

What would $450,000,000 into battery metal mining buy you? Let’s focus on nickel, because high nickel chemistry is likely to be dominant with Australian consumers that tend to prefer larger vehicles (Utes, SUVs) with more range, and Australia is at risk of losing out nickel market share to Indonesia, in particular. In contrast, we have already secured a dominant share of the global lithium market.

Australia is quite well endowed with nickel laterites, albeit sulphides are less capital intensive to develop (their share of global supply is also declining as they are increasingly hard to discover).

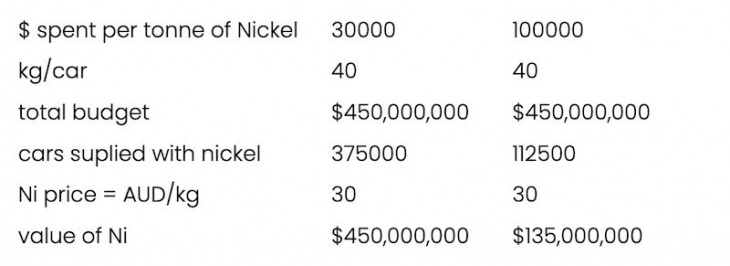

Laterite projects have a capital cost of between $30,000-$100,000 per tonne of nickel supply. So at 40kg nickel per EV, a $450m budget brings on enough nickel supply for 112,000 – 375,000 electric vehicles per annum. The value of this nickel is $135m-$450m/pa (using $30AUD/tonne for Ni). The maths looks like this:

If we put $450m on bond yield terms (say 3% over 10 years) into a nickel mining project, ensuring it gets developed in Australia, this would likely turn on $150m+ worth of exports per annum that was at risk of being lost to a competing mining jurisdiction. With market finance terms typically 12%+ for battery metal mining projects, and usually including a share of royalties and/or equity, these funding terms would likely save a project a minimum of $300m over ten years.

So not only would the Australian government get its $450m back on bond yield terms, over $30m/pa would be saved on mining costs, which could come back to Australian EV consumers or be invested to pursue value adding R&D or commercialisation. For example, for OEM’s to get access to these favorable terms on metal supply, we could require them to pass through discounts to Australian consumers or invest in local value-adding – with strategic leverage, we can have our cake and eat it too.

A financing model for Australian battery metal mining projects deployed at scale would really move this flywheel, including our terms of trade.

For example, if we accept the battery metal market could be $400b/pa AUD by 2030, it is likely that over $200b of capital needs to be deployed into mining projects (ratio of 2:1 revenue to capex). For Australia to capture the lion’s share of this market, we need to deploy $70b+ as quickly as possible, without compromising investment quality.

Using the market for discipline, the Australian government could deploy 50% of project capex requirements ($35b) into mining projects on bond yield terms, reducing the cost of those projects by a combined $2b/pa+. Those savings would give a 5% discount to over 600,000 vehicles per annum (we buy about 1,000,000 new cars per annum).

It’s amazing what a bit of thought and reflection could lead to… don’t you think?

Tosh Szatow is a sustainability and innovation junkie, co-founder at BOOMPower; and idea tinkerer at the Good Ideas Factory.

Keyword: To subsidise, or not to subsidise, electric vehicles – that is the question